2025-10-22

2025-10-22

On October 11, the cryptocurrency market experienced a sudden disruption. Earn products linked to USDE, BNSOL, and WBETH on the Binance platform underwent significant depegging, leading to widespread liquidations of leveraged positions. This event serves as a reminder that even seemingly stable CEX Earn products carry inherent risks. This report provides an in-depth analysis of the risk factors associated with major CEX Earn products, aiming to help investors identify potential vulnerabilities, develop sustainable yield strategies, and maintain resilience under volatile market conditions.

1. Overview of CEX Earn Products: From Passive Income to High-Risk Bets

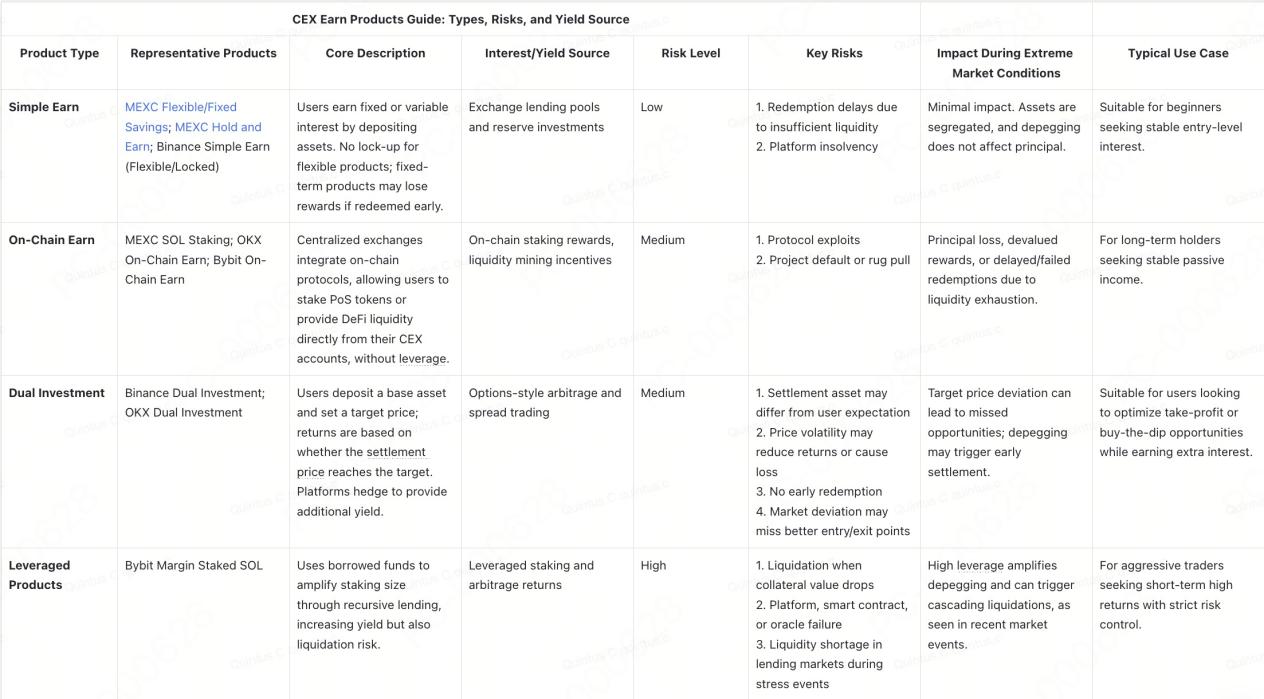

CEX-based Earn products can generally be categorized into four types, ranging from low-risk savings solutions to high-yield, leverage-enhanced products. Lower-risk products function much like crypto fixed deposits, focusing on capital preservation and stable returns, while higher-risk offerings resemble leveraged futures, where both profits and losses are amplified. The following breakdown examines these products across the risk spectrum.

1. Simple Earn

These are the most basic form of CEX interest products, comparable to savings or term deposit accounts offered by traditional banks. Users deposit their assets into flexible or fixed-term accounts on the platform to earn interest. For example, MEXC's USDT Flexible Savings product offers flexible access while maintaining APRs typically between 5% and 20%.

Interest mainly comes from the platform lending funds to institutions, high-frequency traders, or through on-chain staking. These products generally feature low interest rates but also carry minimal risk. Principal funds are usually protected through platform risk controls and are not directly exposed to market fluctuations. Even during extreme market volatility, principal security remains largely unaffected.

Flexible Savings products are particularly suited for emergency funds, providing steady liquidity that can even be used to take advantage of market corrections during downturns.

2. On-Chain Earn

These products essentially integrate DeFi protocols directly into the CEX platform, allowing users to participate in staking, liquidity provision, or liquidity mining directly from their exchange's Web3 wallets, without the need to configure external wallets or conduct complex on-chain operations.

Yields primarily come from DeFi reward mechanisms such as staking returns or liquidity incentives. However, in cases of extreme market stress, these products may face chain-wide liquidity crises, leading to frozen assets, negative yields, or even total capital loss.

3. Dual Asset Investment

Users deposit a base asset and select a trading pair (for example, BTC/USDT), along with a target price and settlement date. Upon maturity, settlement depends on the market price: if the target price is reached, users receive the target asset plus yield; if not, they receive the original asset plus interest.

Returns mainly derive from platform arbitrage opportunities and market volatility, resulting in relatively high annualized yields. However, during sudden market swings, prices may move sharply against the target, leading to unfavorable settlements and locking funds during critical price movements. Dual Investment is suitable for profit-taking in bull markets or bottom-buying in bear markets, but users should carefully assess volatility risk.

4. Leveraged Products

These products incorporate leverage to amplify returns, such as Bybit's Margin Staked SOL, where users stake SOL to get bbSOL, and use BBSOL for trading or in DeFi protocols to generate return.

Users may also manually add leverage. For instance, collateralizing USDE to borrow USDT, using the borrowed USDT to buy more USDE, and repeating the process to reinvest borrowed funds into yield products. Returns come from leverage-enhanced staking or arbitrage yields, offering high potential annualized returns. However, if collateral values drop sharply in volatile markets, liquidations can occur, amplifying losses and rapidly eroding principal. Such products are suitable only for high-risk investors with disciplined risk management.

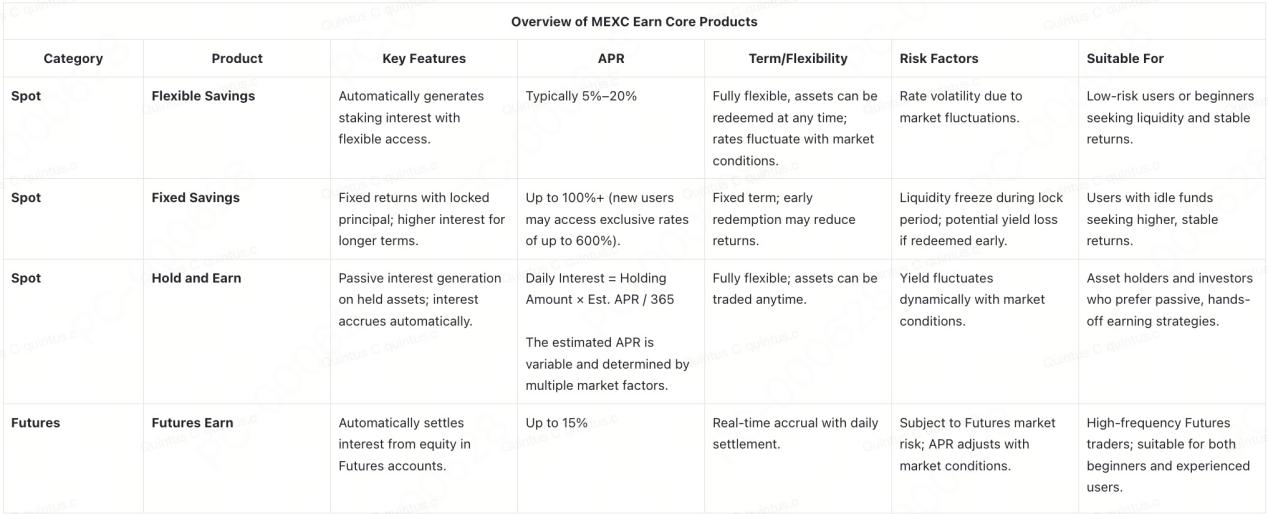

2. MEXC Earn: Core Product Breakdown

As mentioned above, providing users with a stable and sustainable source of returns amid market volatility has become a key factor in building long-term trust for exchanges. The MEXC Earn product ecosystem was developed in response to this need, prioritizing capital preservation, flexible liquidity, and controllable risk. It serves as both a defensive tool in bear markets and a liquidity reserve in preparation for bull markets.

The following section provides a structured breakdown of the core products within the MEXC Earn suite.

1. Core Stable Earn Products: Flexible Savings, Fixed Savings, Hold and Earn, and Futures Earn

Flexible Savings is the most basic type of cryptocurrency Earn product, comparable to a bank savings account. Users can deposit or withdraw funds at any time while earning daily interest on their holdings. The key advantage is liquidity. Assets are not locked and can be freely traded or withdrawn at any time. Interest accrues automatically without the need for staking or manual operations. This product is ideal for newcomers and investors with short-term capital needs seeking convenient and steady returns.

Fixed Savings functions similarly to a bank's fixed-term deposit. Users lock their principal for a set period in exchange for higher returns. During the lock period, funds cannot be traded or withdrawn, but both principal and interest are paid out at maturity. It is important to note that Fixed Savings products have limited liquidity. Early redemption is usually unavailable or may result in reduced returns. Therefore, users should plan their investment duration carefully. In addition, if the locked asset is a volatile non-stablecoin, potential price fluctuations during the lock period may affect overall returns.

Hold and Earn represents MEXC Earn's passive income model. Users earn interest automatically simply by holding eligible cryptocurrencies in their Spot accounts. No action is required. This product provides full flexibility: assets continue to generate interest while remaining available for trading, withdrawal, or other use at any time. MEXC adjusts the interest dynamically based on on-chain returns and the total amount of user holdings, ensuring sustainability and clear yield sources. Hold and Earn is well suited for users seeking low-barrier, passive income opportunities, such as long-term holders or those unfamiliar with complex DeFi operations. In essence, holding assets equals earning interest.

Futures Earn is a recently introduced interest generating feature on MEXC that combines Futures trading with passive income. Once activated, eligible funds in the user's Futures account automatically participate in a dedicated APR program. This allows users to earn daily interest on idle margin balances without affecting normal trading activities. The feature improves capital efficiency by converting unused margin into an additional income source.

The APR is determined by the size of the user's open positions and account balance. In general, Futures accounts earn a base APR of around 3%, while large position holders (equivalent to 100,000 USDT or more) can unlock higher tiers with APRs of up to 15%.

2. Key Highlights

The MEXC Earn product ecosystem incorporates several design strengths that enable it to stand out in today's uncertain market environment. Even amid periods of volatility, the platform has continued to deliver consistent payouts, demonstrating both its stability and resilience.

During the "10.11 incident," one of the sharpest market downturns in crypto history, total liquidations exceeded $19 billion within 24 hours, and Bitcoin dropped over 13%. During the period, MEXC Earn maintained normal operations. All products continued to distribute interest on schedule, with no delays or withdrawal issues. Because interest distributions are not tied to high-risk strategies, the market decline did not affect income generation. MEXC's risk control measures and reserve management ensured adequate liquidity for redemptions. User data showed that Flexible Savings and Hold and Earn continued paying daily interest, while Fixed Savings matured and settled as usual, with no redemption restrictions.

3. Conclusion

"Earn, Don't burn." Rather than chasing excessive returns in volatile markets, a steady earning approach allows assets to grow consistently, a mindset especially valuable in today's environment. For investors, allocating part of their portfolio to reliable Earn products can serve as an effective strategy to hedge market risks and smooth long-term returns. Stability does not mean the absence of risk, but as demonstrated by MEXC Earn, with the right platform, sound product selection, and disciplined participation, achieving steady and sustainable interest accrual remains an attainable goal.